From Homeowner Savings to REIT Riches

Why "Small Efficiencies" Drive Millions for Large-Scale Property Portfolios

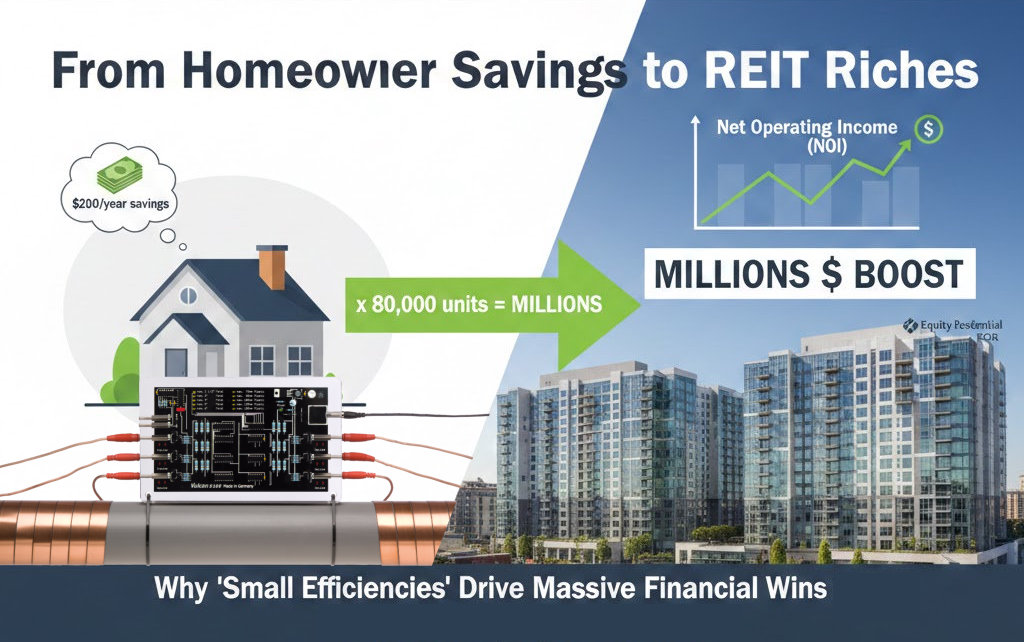

For most homeowners, saving a couple of hundred dollars a year on appliance maintenance or energy bills feels like a win. But what happens when you take that same $200 saving and multiply it by hundreds of thousands of times? For a real estate titan, those small, incremental efficiencies multiply into millions of dollars annually, directly impacting their Net Operating Income (NOI).

The Homeowner's Win vs. The Portfolio Jackpot

Individual Homeowner

Protects appliances and saves on repairs for a single residence.

$200 / yr

Tangible SavingsInstitutional Portfolio

300 Buildings | 80,000 Units

$4,000,000 / yr

Annual NOI BoostHow Small Efficiencies Fuel Net Operating Income (NOI)

Fewer emergency plumbing calls for clogged pipes and boilers. Assets like water heaters and washing machines last longer, delaying expensive CapEx replacement. Furthermore, it eliminates the recurring cost and labor of salt delivery.

The Strategic Imperative

Scalable

Portfolio-wide rollout

Low Maint

Set and forget

Verifiable ROI

Quantifiable gains

Sustainable

Zero chemical waste

Small efficiencies become massive financial wins when multiplied across a vast footprint.

The "Vulcan Meaning" of Scale

Small efficiencies become massive financial wins when multiplied across a vast footprint. It is the ultimate strategic lever for the modern property giant.

Strategic Acquisition Criteria

For asset managers, evaluating new technologies requires a framework that balances immediate ROI with long-term portfolio health.

| Priority Pillar | Institutional Impact |

|---|---|

| Scalability | Seamless rollout across 300+ properties without customization. |

| Maintenance | "Set and forget" logic—minimizes on-site staff labor hours. |

| Verifiable ROI | Quantifiable reduction in emergency plumbing OpEx. |

| Sustainability | Zero chemicals; aligns with GRESB and ESG carbon goals. |

Key Performance Indicators

-

CriticalNOI GrowthDirect boost via expense reduction.

-

HighAsset ValuationHigher income = Higher cap rate value.

-

StrategicESG ComplianceMeets green building standards.